Andrii Yalanskyi

Following a mixed results in the fourth quarter report, Jon Gray, Blackstone (New York stock market :Bx) chairman and COO, said Thursday that headwinds from rising interest rates led to a “challenging” quarter for segments of the real estate sector.

However, Gray said CNBC that over the longer term, the higher cost of capital would limit the amount of new supply that can come to market. “It’s a tailwind for real estate,” he said.

“We adjusted that [higher interest rates] in our portfolio with higher capitalization rates. But when you look into asset classes, it’s really dramatic. The differences if you look at the US office market, they can see subletting today is north of 20% and rents are going down, and that’s a very tough industry,” Gray added.

Given the challenging market conditions in 2022, the company has deployed most of its capital in travel and travel-related businesses, logistics, its hedge fund operations, quantitative and macro investments, energy and energy transition, Gray reported.

In its results, the company’s earnings rose 8% in the fourth quarter, with assets under management up 11%. Segment performance: Real Estate – Opportunistic -2.0%; Heart -1.5%; Private Equity – Corporate Private Equity +3.8%; Tactical Opportunities +0.6%; Secondary -1.8%; Hedge Fund Solutions – +2.1%; Credit & Insurance – Individual Credit +2.4%; Liquid Credit +3.0%.

However, the alternative asset manager fell short of its expectations of reaching $1 trillion in assets under management by the end of 2022. It reported assets under management of $975 billion, compared to $951 billion in the previous quarter.

As for the stock move, BX was trading at $92.49 in Thursday’s intraday action, up more than 4% on its earnings report.

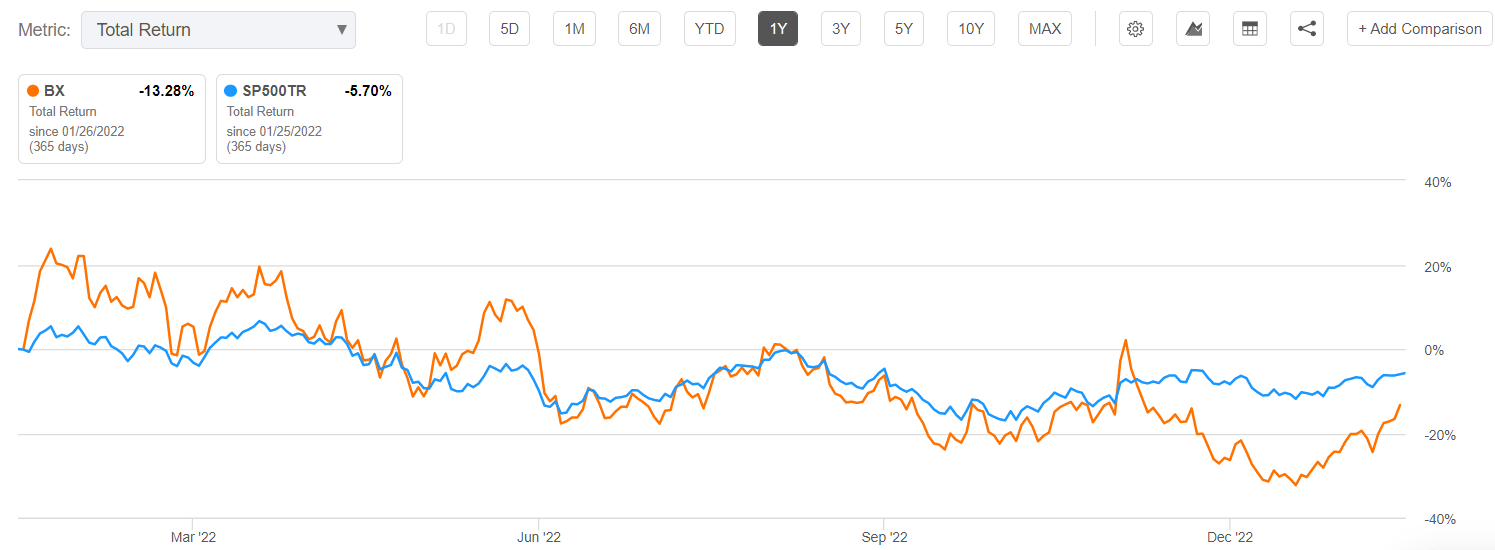

Looking further ahead, equities have lost around 17.3% over the past 12 months, although they have rebounded with 21% gains so far in 2023.

In the meantime, see why Seeking Alpha contributor Samuel Smith says: “Investors will generally be drawn away (and valuations fall) from BX’s real estate and private equity products as interest rates rise.”

A quick comparison of BX with a broader market index: