Elena Kurkutova | Istock | Getty Images

Older Americans may have a number of different goals with their retirement savings. But usually, their main goal is the same: to make it last.

Unfortunately, many young baby boomers and later generations who don’t have access to a traditional pension could outlive the funds in their 401(k) accounts, a recent study from the Center for Retirement Research at Boston College.

Economists have compared drawdown speeds between those with traditional pensions and those with only 401(k) savings accounts. Although most research on the lifespan of retiree money is based on the first category, the majority of people now fall into the second.

Retirees with 401(k)s often spend their savings quickly

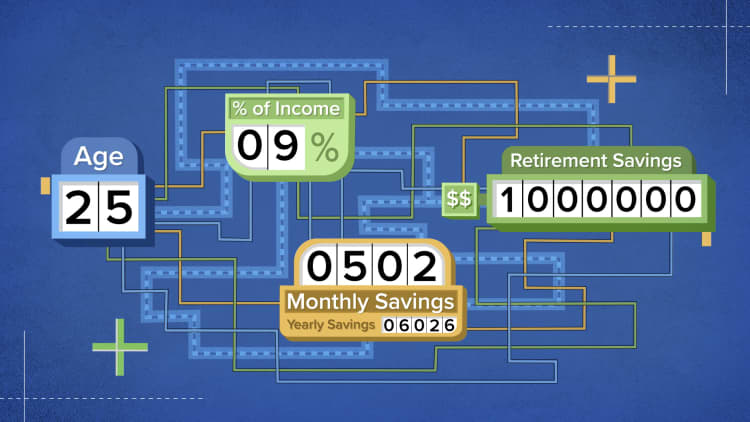

Access to traditional pensions has been rare for decades. Workers have increasingly been tasked with saving themselves for their final years in investment accounts, the flagship child of which has been the 401(k) plan offered by employers.

Researchers have found that these plans run out much faster than expected.

An example in the analysis looked at households that entered retirement with $200,000 in savings. At age 70, retirees who had a 401(k) plan but no pension had $28,000 less than retirees with a pension, according to their analysis — a difference that equals one-eighth of that starting balance. At age 75, 401(k) savers had $86,000 less than those who had a pension.

“People spend a lot of what they have when they have a 401(k),” Wettstein said.

The rapid withdrawal of savings from 401(k) accounts means that many retirees who rely on them are at risk of exhausting their funds entirely by age 85, although about half will live beyond beyond, according to the study.

While they’ll still get their monthly Social Security checks, Wettstein said, “that’s usually not a good enough replacement for their career earnings.”

Pensions helped ‘how much you could afford’

Because of the relatively new nature of 401(k) plans, more has yet to be learned about why retirees are spending their accounts so quickly, Wettstein said.

Still, some of the reasons can be assumed. Those with a traditional pension, which guaranteed a fixed payment each month until death, probably had less need to turn to their savings because of this reliable income. They may have been able to save their savings for inheritance purposes or for unexpected expenses later in life.

We did this as a first look at whether we should be concerned.

Gal Wettstein

senior research economist at the Center for Retirement Research at Boston College

On the other hand, many retirees without a pension depend on their own savings to cover a large part of their monthly expenses. Without a pension, people are also left to make sure they’ve saved enough to get through their after-work years, a task that requires decades of adequate income and discipline.

Additionally, a challenge with 401(k) savings plans is that they task retirees with determining how much to withdraw each month. This calculation can be difficult to do correctly, and although those with significant savings aim to live off the income of their money, the market is unpredictable and has times – like right now – when it takes more than it needs. given.

“One of the benefits of the pension system was that it gave you reassurance about how much you could afford to spend, practically, in that it would never run out, and in the sense of advice too, because it said: ‘Here you can spend as much, because next month you will get the same amount again,’ Wettstein said. “A 401(k) doesn’t get you that.”

Wettstein pointed out that it’s still early days to get a full picture of the success of 401(k) accounts among retirees.

“But we did this as a first look at whether we should be worried,” he said. “And the conclusion that we came to is, yes, we should.”

This article was written with the support of a Journalism Fellowship from the Gerontological Society of America, the Journalists Network on Generations, and the Silver Century Foundation.