ST. PAUL — An insurance company is not required to cover repair costs for pre-existing structural damage to a St. Paul’s Church discovered during repairs in a 2017 windstorm, the Minnesota Supreme Court has ruled.

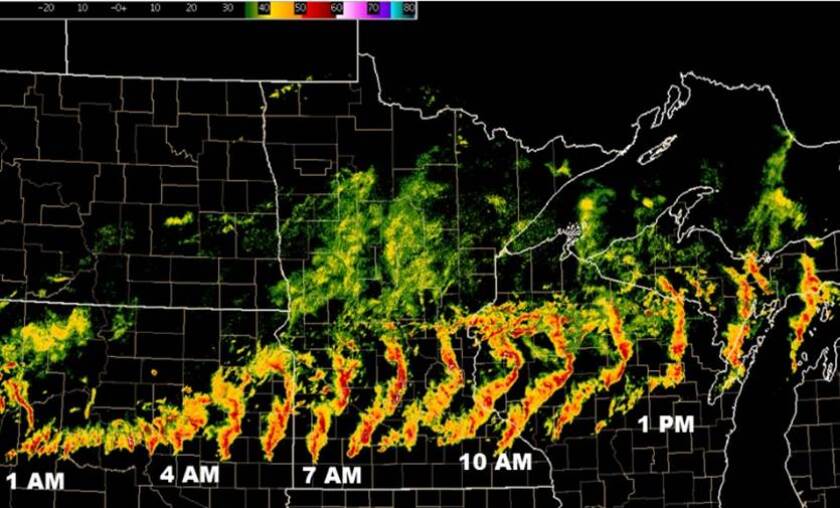

The 25-page opinion that ruled 4-3 in favor of State Farm stems from the morning hours of June 11, 2017, when a line of severe thunderstorms rolled through the southern half of Minnesota, bringing high winds and a large hail.

Storm reports from the National Weather Service say hail the size of golf balls fell across much of the Twin Cities, as winds in the Metro gusted to 70 mph or stronger, snapping trees between six and 12 inches in diameter.

Contributed / National Weather Service

The structures were also not immune to the impact of the storm.

St. Matthews Church of God and Christ, about 2 miles southwest of the Minnesota State Capitol, suffered more than $100,000 in damage, all of which was paid for by State Farm.

During the repair process, workers discovered cracks in the building’s masonry behind damaged drywall, and the city determined that the structure was not up to code.

“St. Matthews then asked State Farm to pay the cost of bringing the masonry up to standard. In response, State Farm hired a consultant to assess the damaged masonry and determine the cause of the damage,” reads the statement. opinion of the Supreme Court “The consultant concluded that the ‘cracked and out of plumb condition … was a long-term condition unrelated to the storm’.”

Even before State Farm sent a letter to the church refusing to cover the damage to the masonry, St. Matthews filed a lawsuit, in which a district court ordered State Farm to assess the damages, which she later valued at just under $80,000. The assessment clearly indicated that the damage was not the result of the storm.

After the district court ruled in favor of State Farm, determining that the insurance company should reimburse the church only for damages incurred as a direct result of the June 11, 2017 storm, St. Matthews appealed the case.

After an appeals court upheld the lower court’s decision, a second appeal was filed and the Minnesota Supreme Court granted a review of the motion and ultimately upheld the lower court rulings.

The opinion, written by Judge Paul Thissen, found that because the brickwork damage predated the storm and no evidence was presented that the church was covered by State Farm at the time the damage structural damage has occurred, the insurer is not responsible for reimbursement of repairs. the costs, as the “damaged part of the property” was strictly the drywall. Chief Justice Lorie Skjerven Gildea and Justices Barry Anderson and Gordon Moore joined Thissen in the majority opinion.

In a dissenting opinion, Judge Natalie Hudson countered Thissen, accepting St. Matthews’ argument that “a wall is a wall” and that the insurer’s obligation to repair “the damaged part of the property” would include masonry behind the wall.

Although Hudson wrote that the majority opinion regarding “the damaged part of the property” is a reasonable interpretation of the law, she argued that it should not be taken as the only interpretation. Justices Margaret Chutich and Anne McKeig agreed with Hudson’s dissent.