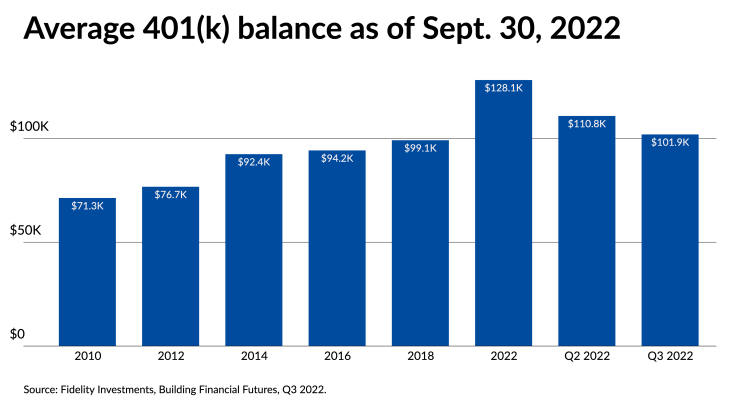

The Wall Street slowdown and lingering inflation are weighing on millions of Americans with retirement plans, a further blow to savers who have long worried about not having enough inventory for their golden years.

A new report from Fidelity Investments found savers were significantly more pessimistic in the second week of September compared to a year ago.

Get grumpy

Almost one in three people of all ages, or 32%, had “negative feelings about their finances”, a significant increase from 22% a year ago. Only 30% had a positive view of their financial situation, a third less than a year ago.

Save less

Rising consumer prices generally leave less money to invest in long-term nest eggs. Two in five, or 41%, saved less in the third quarter compared to the previous three months. In the second quarter, only 27% saved less.

Fidelity’s data for the third quarter of 2022, which it considers a snapshot of consumer sentiment from July to September, comes from a survey of 1,513 Fidelity-sponsored pension plan participants between the 8th and 17th September and a review of 24,500 corporate defined contribution plans and 22.1 million participants as of September 30.

Here are the other key results of Fidelity Third Quarter 2022 Building Financial Futures Report.

401(k) contributions hold up most of the time, but some savers slip

While average retirement account balance has fallen, 401(k) plan savings rates are ‘strong’ and percentage of employees with plan loans remained low for sixth straight quarter, report says .

Still, the third quarter showed that some workers lowered their contribution rates. Some 3.7% of savers reduced the amount of their contributions to 401(k) and 403(b) plans in the third quarter compared to the April-June period (the latter plans are aimed at teachers and school employees). public sector). The average reduction is 6.7%.

Overall, the majority of savers kept their rates at the same level as in the previous quarter. But a slice, less than 1%, stopped contributing entirely.

Baby boomers pump money into employer-sponsored plans

Most workers, 86%, kept their 401(k) contribution rates unchanged from the previous quarter; 7.8% increased their rate, by an average of 3.2%.

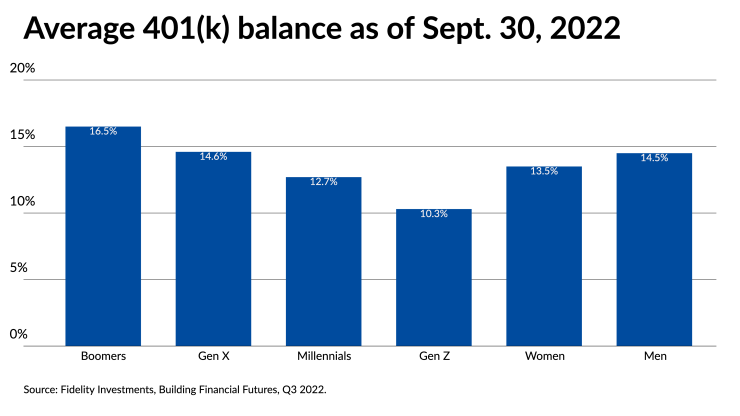

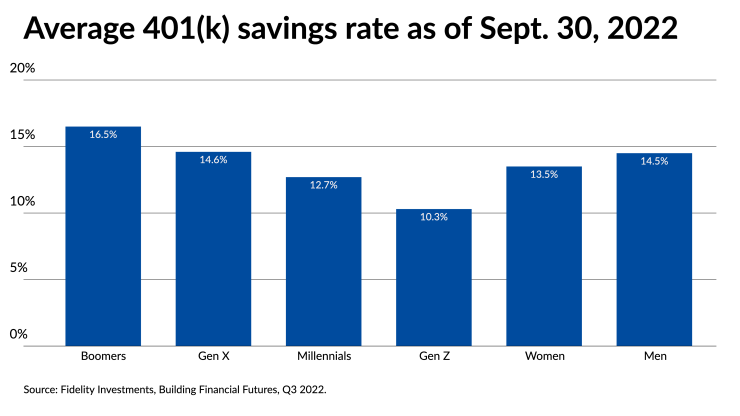

Men continued to save at higher rates than women (14.5% versus 13.5%), while pre-retired baby boomers saved at the highest levels (16.5%).

Gen Z participants increased their savings level from 10.3% to 10.3%.

The average contribution rate at all ages remained relatively stable at 13.8% (compared to 13.9% in Q2 2022 and 14.0% in Q1 2022), which is just below the savings rate suggested by Fidelity 15% of pre-tax income.

“Despite growing overall negative consumer sentiment,one area where people haven’t put the brakes yet is on retirement savings“said a statement that accompanied the report.

Men continued to save at higher rates than women (14.5% versus 13.5%), while pre-retired baby boomers saved at the highest levels (16.5%).

Gen Z participants increased their savings level by 10.3% instead of 10%.

Millennial women are on it

The number of individual, traditional and Roth retirement accounts held by millennial women increased 25.5% in the third quarter compared to a year ago. Fidelity defines this generation as those born between 1981 and 1995.

Roth’s rule

Americans increasingly prefer Roth retirement plans to traditional IRAs. The latter are usually funded with dollars on which taxes have not yet been paid, although savers can also inject after-tax dollars. In contrast, the Roths are funded with after-tax dollars and withdrawals are tax-free.

“Across generations, Roth IRAs are the retirement savings vehicle of choice, with 61.0% of all IRA contributions going to Roth in the third quarter of 2022,” Fidelity said.

The number of Roth IRAs held by millennials rose 5.8% from a year ago, but overall dollar contributions fell 4.2%.