TexBr/iStock via Getty Images

By Christophe Anguiano

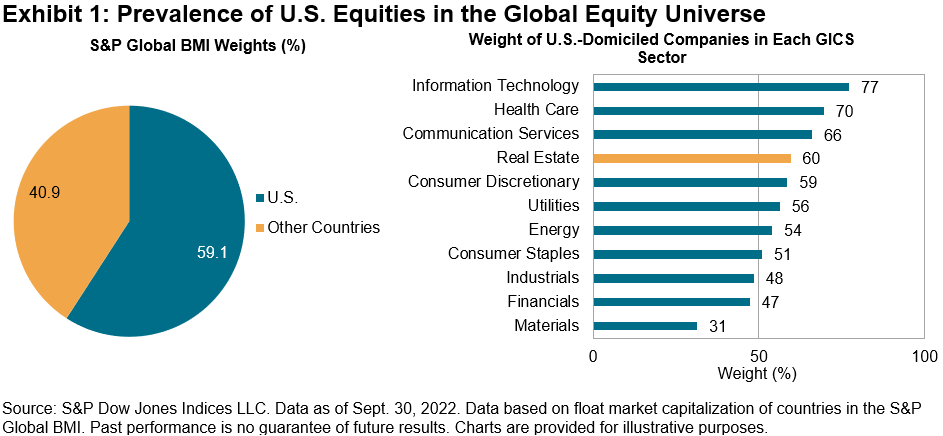

Predominance of American equities

US equities represent 59.1% of the total global equity market by free-float market capitalization (TMC) and at least 50% of the weight of 8 of the 11 GICS sectors globally. Given the trends and narratives, US equities seem to have an outsized role in explaining performance globally and can help investors understand market dynamics.

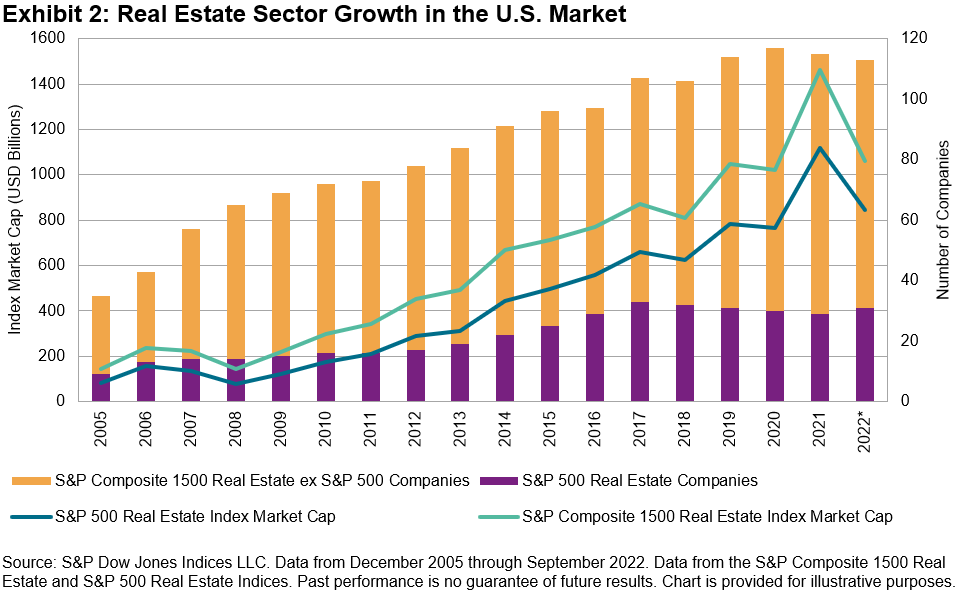

Evolution of the real estate sector

US-domiciled companies accounted for 60% of the free float market capitalization of the global real estate sector as of September 30, 2022, and real estate companies in the US market have grown in number and size over the past decade. For example, Exhibit 2 shows that there were 113 real estate companies in the S&P Composite 1500® at the end of September 2022, with a collective CMF of 1,060 billion USD, compared to 35 companies with 142 billion USD of CMF at the end of 2005.

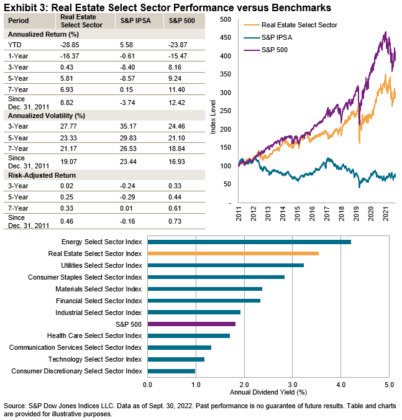

Long-term risk/reward characteristics

The S&P IPSA, the benchmark index for Chilean large caps, has posted strong returns year-to-date. But in the long term, the United States Real estate Select a sector and the S&P 500® outperformed with lower return volatility.

Combined with the relatively low five-year moving average correlation (0.33) between the Real Estate Select sector and the S&P IPSA historically, Chilean market participants may wish to consider the potential diversification of integrating US real estate and Broader US equities.

The Real Estate Select sector has grown in recent years and has offered a higher dividend yield than the S&P 500 and many of its GICS sector segments. Therefore, this sector and the US equity market may be of interest to Chilean investors, especially in the current inflationary environment.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information about S&P DJI, please visit S&P Dow Jones Indices. For terms of use and full disclosures, please visit Terms of use.

Editor’s note: The summary bullet points for this article were chosen by the Seeking Alpha editors.