Walrus Pictures | Stone | Getty Images

Retirement accounts are meant to fund your lifestyle for years to come – and attacking them early usually comes with a hefty financial penalty.

But there are some situations in which account holders — both those with savings in individual retirement accounts and workplace plans like a 401(k) — can access that money early without penalty.

Not that they necessarily have to.

“The worst thing you can do is take money out of your retirement account before its destination, because then what will happen to your retirement?” said Ed Slott, a chartered accountant and IRA expert based in Rockville Center, New York. “I would only do this if it was the last resort and it was the only money you had.”

Learn more about personal finance:

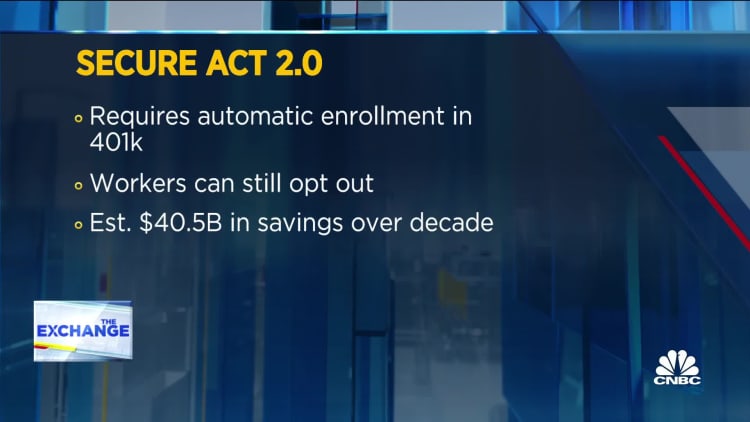

Secure 2.0 bill on track to usher in pension system improvements

New pension law leaves ‘huge problem untouched’

New emergency savings rules could help bolster financial security

Savers in general incur a 10% tax penalty if they withdraw money from a retirement account before age 59.5. This is in addition to any income tax resulting from the withdrawal.

The list below outlines situations in which IRA owners would not be liable for the 10% early withdrawal penalty.

Congress may soon add more. A $1.7 trillion legislative package to fund the federal government for fiscal year 2023 contains a multitude of retirement provisionscollectively named “Secure 2.0The measure, expected to pass within days, would add exceptions to the early withdrawal penalty for IRA owners in cases of domestic violence and terminal illness, for example.

here are the current exceptions for those under 59 and a half.

(Note: The first three apply only to IRAs. The others can apply to both IRAs and workplace retirement plans.)

1. Higher education expenditure

You may be exempt from the penalty if IRA funds are used to pay eligible college fees for you, your spouse, or your or your spouse’s children or grandchildren.

Eligible costs include tuition, fees, books, supplies, equipment required for a student’s enrollment or attendance, and expenses for certain special needs services. Room and board are also eligible for students attending school at least half-time.

Students must be attending a college, university, vocational school, or other institution that can participate in U.S. Department of Education student aid programs. (They include “virtually all” accredited, public, nonprofit and private for-profit institutions, according to the IRS.)

2. First-time home buyer

Contrary to what the IRS title might suggest, IRA owners do not have to be first-time home buyers to qualify for this exception. The IRS generally defines a first-time buyer as someone who hasn’t owned a home in the past two years.

These IRA owners can withdraw up to $10,000 without penalty. This monetary threshold is a lifetime maximum.

Funds must be used for “qualified acquisition costs”. These are: the costs of buying, building, or rebuilding a home, and “any customary or reasonable settlement, financing, or other closing costs,” according to the IRS. Money must be used within 120 days of receipt.

The IRA withdrawal can be used for you, a spouse, or your child, among other eligible family members. If you and your spouse are both first-time homebuyers, each can accept distributions of up to $10,000 without penalty.

The two-year limitation period begins on the “acquisition date”: the day you enter into a firm purchase agreement or the day construction or reconstruction begins.

3. Health insurance if unemployed

Distributions to cover health insurance premiums for you, your spouse and your dependents may not be subject to a penalty if you have lost your job.

To qualify, you must have received unemployment compensation (through a federal or state program) for 12 consecutive weeks. The IRA withdrawal must also occur in the year you received unemployment or the year after. In addition, you must take the withdrawal within 60 days of your re-employment.

4. Death

Rubber bullet productions | Getty Images

Beneficiaries who inherit an IRA on the death of the owner are generally not subject to a penalty if they withdraw money from the inherited account before age 59½.

5. Unreimbursed medical expenses

A distribution to cover medical expenses cannot be punished.

The exception applies to unreimbursed medical expenses that exceed 7.5% of your annual adjusted gross income. The applicable income is that of the year of withdrawal.

For example, if your AGI is $100,000 in 2022, you can use a withdrawal that year to cover unreimbursed medical expenses over $7,500.

You do not need to itemize tax deductions to receive this benefit. (In other words, you can still get it if you take the standard deduction.)

Slott warned of a year-end hiccup. If you put a medical bill on your credit card this week or next week, those medical bills will count for the 2022 tax year — even if the credit card bill itself isn’t paid until 2023.

This means that an IRA withdrawal related to these medical expenses would need to occur in 2022, not 2023, to receive the tax benefit.

6. Birth or adoption

Each parent can use up to $5,000 per birth or adoption from their respective retirement accounts. The funds would cover associated expenses.

Account withdrawal must be made within one year of your child’s birth or the date your child’s legal adoption was finalized.

7. Disability

Certain disabled savers under the age of 59.5 are not liable for the penalty tax.

To qualify, they must be “totally and permanently disabled”. The IRS defines this as being unable to do “any substantial gainful activity” due to physical or mental condition. A physician must certify that the condition “may result in death or be of long, continuous, and indefinite duration.”

Overall, it’s a rigid definition that’s hard to stick to, Slott said. In practice, someone usually has to be near death or bedridden and unable to work, he said.

8. Tax levy

You will not incur a penalty if the distribution results from an IRS tax levy (i.e. if the IRS takes your retirement funds to settle a tax liability).

9. Active Reservists

Videodet | Istock | Getty Images

Army, Navy, Marine Corps, Air Force, Coast Guard, or Public Health Service reservists may be exempt from penalties.

They must have been commissioned or called into active service after September 11, 2001 and in service for 180 days or more or for an indefinite period.

Their accounting distribution cannot be made before the date of recall to active service and at the latest at the end of the period of active service.

10. Substantially Equal Periodic Payments

This exemption for IRA owners is “very complicated” and likely requires the help of an accountant or advisor, Slott said.

Simply put, a taxpayer can avoid a penalty by sticking to a formula that describes an amount of periodic account distributions (at least one per year). These “substantially equal periodic payments” are like an annuity and are also known as 72