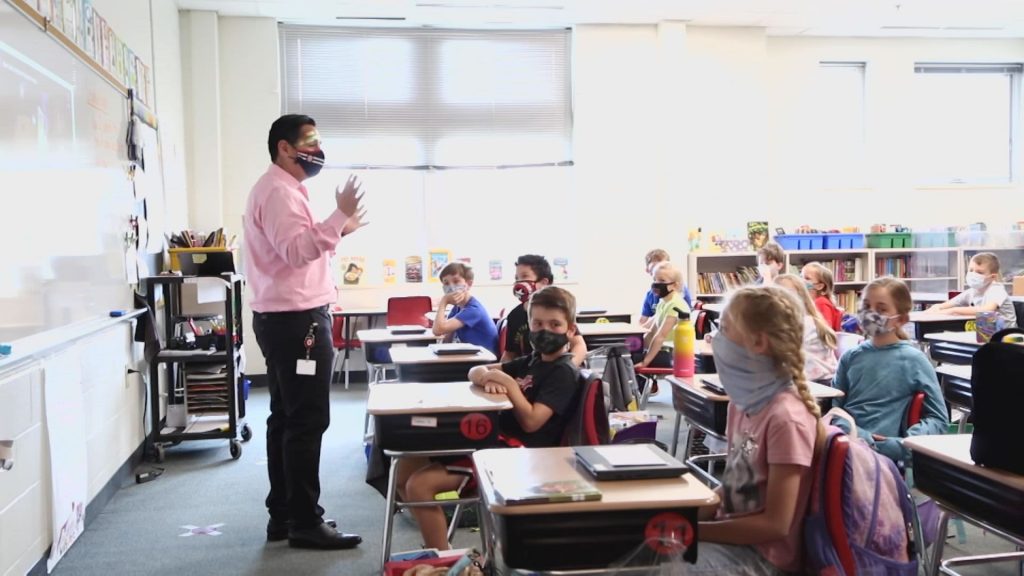

Lee Jimenez, a teacher at Indian Hill Elementary School in Cincinnati, Ohio, discusses credit cards and payment methods with his 3rd grade class using the SmartPath online financial education program.

SMARTPATH

There is momentum for personal finance education becomes law in many states across the country.

Nearly half of states already mandate such education, and more states could pass legislation this year to ensure students, especially high school students, have it before they graduate.

“It’s been a huge change,” said John Pelletier, director of the Center for Financial Literacy at Champlain College in Burlington, Vermont.

Prior to the coronavirus pandemic, progress in personal financial education had stalled, he said. But amid the pandemic layoffs and ensuing recession, it’s become clear that financial literacy is hugely important for students.

“What seems to be pushing these bills forward is a disaster,” Pelletier said.

Who’s next

Georgia will likely be the next state to pass a personal finance education requirement, according to Next Gen Personal Finance, a nonprofit organization.

Both houses of the state assembly passed a bill, SB 220, that would require all high school students to take at least one half-credit financial literacy course to graduate, to from the 2024-25 school year. The bill awaits the governor’s signature to become law.

South Carolina may also soon pass legislation mandating personal finance education. The state has a bill, S16, which is currently in conference committee. Once Georgia’s bill is signed into law, South Carolina will be the only state in the Southeast that won’t require personal finance courses, according to Tim Ranzetta, co-founder of Next Gen Personal Finance.

“I think there is an element of [fear of missing out] happening between states,” Ranzetta said. “That’s why we’re seeing the trend there.”

Learn more about Investing in You:

How to decide if you should rent or own a house

US households are spending $327 more per month due to inflation

Inflation eating away at your budget? Here are 3 ways to defend yourself

Michigan could also move legislation forward in the coming months. A bill that would require a half-credit personal finance course for high school graduation passed the state House of Representatives in December and is expected to pass the US Senate. state in May.

In Minnesota, an omnibus education bill would require high school freshmen starting in the 2023-24 school year to take at least one half-credit personal finance course to graduate. And, in New Hampshire, an education bill includes personal finance on a list of things that constitute a proper education.

Overall, 23 U.S. states have some sort of personal finance education mandate, according to the 2022 State Survey of the Economic Education Council. And 47 states include personal finance language in their public education standards, though many do not have required courses.

Next Gen Personal Finance said that, so far, 12 states meet its gold standard for personal finance education, which means they require or will soon require at least one standalone personal finance course in personal finance. half credit towards high school graduation.

A popular formation

Data shows that students and their parents want better personal financial education available in public schools.

According to Next Gen Personal Finance, in California, Florida, Georgia, Michigan and South Carolina, 80% or more of respondents favored financial literacy classes.

In many states, legislation has also passed with bipartisan support, often overwhelmingly on both sides of the political aisle. In In Florida, for example, bipartisan legislation passed unanimously in March.

“It’s one of those common-sense questions that crosses political parties,” Ranzetta said.

And after

Some parents say it’s their responsibility, not the schools’, to teach their kids about money. But few do the work, and many parents haven’t had enough personal finance training themselves.

That leaves it up to state boards of education to include personal finance education in laws.

So far in 2022, 61 personal finance education bills have been proposed in 26 states, according to Next Gen Personal Finance. Of those, 47 bills in 20 states are still in effect, meaning they could one day become law.

In addition to pushing for legislation mandating financial literacy classes, advocates are examining the quality of each proposed bill and whether it includes teacher training. This is an important piece of the puzzle because students need confident, qualified teachers who can explain finance.

“Teachers want to be trained in personal finance so they can give the best to their students,” said Michael Sheffer, director of education at FoolProof Foundationwhich offers a free financial education program for students and teachers.

The increased appetite for personal finance courses has helped provide higher quality education for teachers, a trend that is expected to continue, he said.

They’re well on their way to making that a reality, according to Sheffer.

“It’s a snowball coming down now, and it’s getting bigger and bigger,” he said.

REGISTER: Money 101 is an 8-week financial freedom learning course, delivered weekly to your inbox. For the Spanish version, Dinero 101, click here.

CHECK: 74-year-old retiree became a model: “You don’t have to blend in” with Tassels + CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Tassels.