Personal finance experts Dave Ramsey and George Kamel offer advice on how to avoid credit card debt.

It might be time to cut the card.

As inflation continues to rise, credit card interest rates also increased by 22% on average, according to Lending Tree.

Personal finance expert Dave Ramsey of Ramsey Solutions, best-selling author of “Baby Steps Millionaire” and other books, told “Fox & Friends” on Monday that the best way to get around high rates and rising debt is to ditch the credit card completely.

DAVE RAMSEY’S BEST TIP FOR FIXING CREDIT CARD DEBT: ‘PEOPLE HAVE SUFFERING’

“I got rid of credit cards a long time ago and switched to a debit card,” he said.

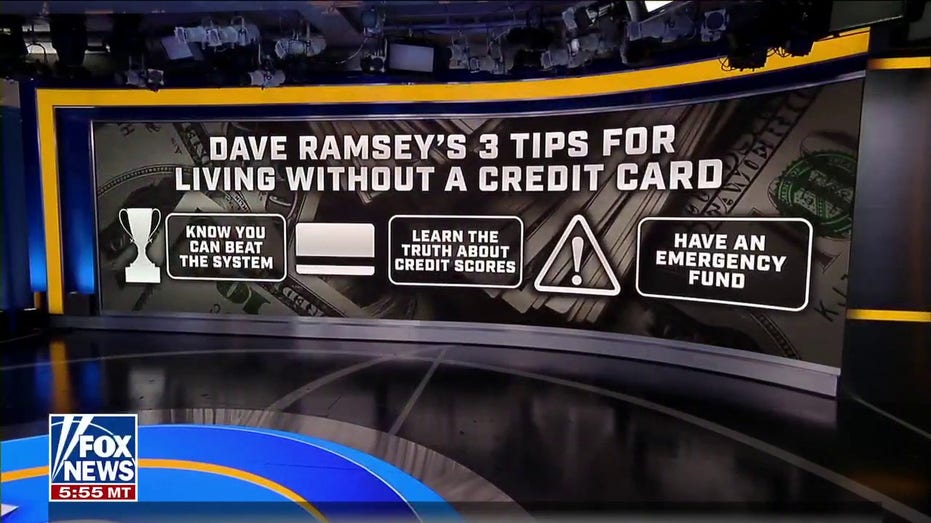

Ramsey offered some tips for living without a credit card, including learning the truth about credit scores and knowing that it’s possible to beat the system.

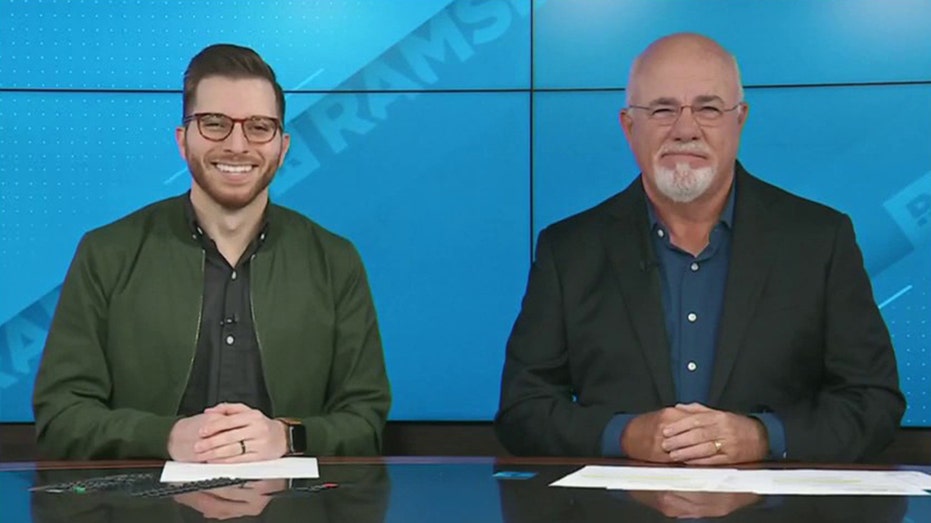

Ramsey Solutions personal finance experts George Kamel (left) and ‘Baby Steps Millionaire’ bestselling author Dave Ramsey joined ‘Fox and Friends’ on Monday, October 24, 2022. (Fox News / Fox News)

Ramsey Solutions personal finance expert George Kamel chimed in, noting that it’s possible to rise above the credit card numbers game.

WHY YOU SHOULD NOT PUT A CHARGE ON YOUR CREDIT CARD AMID CURRENT HIGH INFLATION

“You don’t have to play this game to try and get 2% back while [dealing with] 22% interest,” he said. “That’s crazy.”

One of the biggest consumer concerns about ditching their credit cards is the loss of their credit score.

Dave Ramsey of Ramsey Solutions shared three tips for living without a credit card on “Fox and Friends” on Monday, October 24, 2022. (Fox News / Fox News)

But Kamel said that “valuable” score is completely useless.

“I haven’t had a credit score in years, and I’ve learned that you can rent apartments, you can rent cars, you can rent hotels,” he said.

BILLIONAIRE DAVID RUBENSTEIN AT NATIONAL BOOK FESTIVAL REVEALS TRAITS SHARED BY SUCCESSFUL INVESTORS

“I even bought a house without a credit score.”

Ramsey agreed that a high credit score is just proof that a consumer is good at getting into debt.

A woman holding several credit cards. “Are you going to keep playing ‘kissy-face’ with them [the banks] and then I wonder why you’re broke?” Dave Ramsey said this week. (iStock/iStock)

“The algorithm that FICO uses to create your credit score is 100% based on how many times you play ‘kissy-face’ with the bank,” he said.

“Are you going to keep playing ‘kissy-face’ with them and then wonder why you’re broke?”

HIGH INFLATION: HOW TO CUT $200 FROM YOUR MONTHLY BUDGET

The expert offered another advice to consumers: have an emergency fund on hand at all times.

Ramsey Solutions found that 36% of Americans can’t cover a $400 emergency — and instead turn to their credit cards for that kind of need.

A shopper pays with a credit card – what George Kamel calls a “plastic crutch”. He also said, “Americans now have $887 billion in credit card debt — that’s half of all the student loan debt out there.” (iStock/iStock)

“It’s a plastic crutch,” Kamel said.

“Americans now have $887 billion in credit card debt – that’s half of all the student loan debt out there.”

Kamel explained that many consumers have fallen into the “trap” of using a credit card to accumulate points and improve their credit score.

GET FOX BUSINESS ON THE ROAD BY CLICKING HERE

Yet because of inflation, Ramsey said consumers continue to “dive” into credit cards with these high interest rates – which is just another way banks are “fucking you” , he said bluntly.

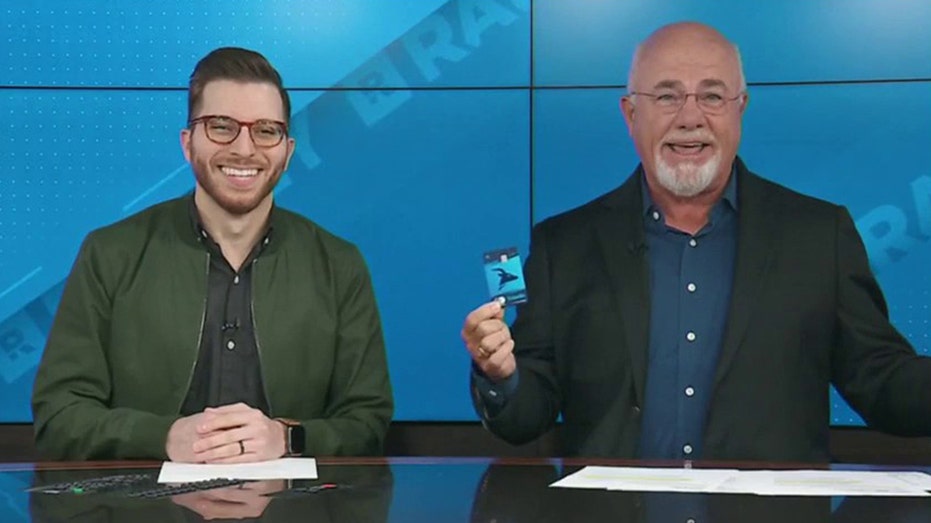

Ramsey announced that his team had launched its own debit card called Gazelle, with no fees or debt.

“Not to fuck you,” he said. “What a good idea !”

Dave Ramsey (right) holds up a Gazelle debit card created by Ramsey Solutions during a “Fox and Friends” appearance on Monday, October 24, 2022. (Fox News / Fox News)

He added that inflation is “a bit scary” for everyone, but added that it’s worth remembering that “you don’t make good decisions when you’re scared”.

He also said, “Come back from the emotion and say, ‘I’m going to make the money I have, behave yourself,'” he said.

DAVE RAMSEY SHARES STRESS MANAGEMENT SECRETS ON RISE COSTS OF TRAVEL, GASOLINE AND MORE

In other words, he added, “‘I can’t control all this stuff that comes my way, but I can control how I react to it.'”

He also said, “You don’t want [be] pay off the debt in five years that you ran while scared during Biden’s inflationary era.”

Says Dave Ramsey, “Banks make their money off people like you and me preying on their loan and credit card offers.” He added: “Get rid of credit cards NOW so you don’t use them in a moment of weakness.” (Ramsey/iStock/iStock Solutions)

Ramsey told Fox News Digital, “80% of the banking industry’s revenue comes from interest on loans. That’s absolutely ridiculous!”

He added: “That’s why they have the tallest buildings with the most beautiful lobbies in every city. The banks make their money off people like you and me who fall prey to their loan offers and credit card, which is exactly why we wanted to make our own debit card that does NOT put you in debt.”

“Credit cards are a short-term option that only fails you later.”

He also said: “I get it. It’s hard to make ends meet right now with inflation out of control, and it can be tempting to take the easy way out – put the expenses on a credit card – instead of saying “No” to organic milk at the grocery store.

Still, “credit cards are a short-term option that only sets you up for failure later,” he said. “You will be have to pay it back, and now you have to pay it back with 22% interest!”

CLICK HERE TO LEARN MORE ABOUT FOX BUSINESS

Says Ramsey, “That’s not good financial decision making. Get rid of credit cards NOW so you don’t use them in a moment of weakness.”

He also said, “Making the necessary sacrifices now will help you weather this storm and come out stronger on the other side.”