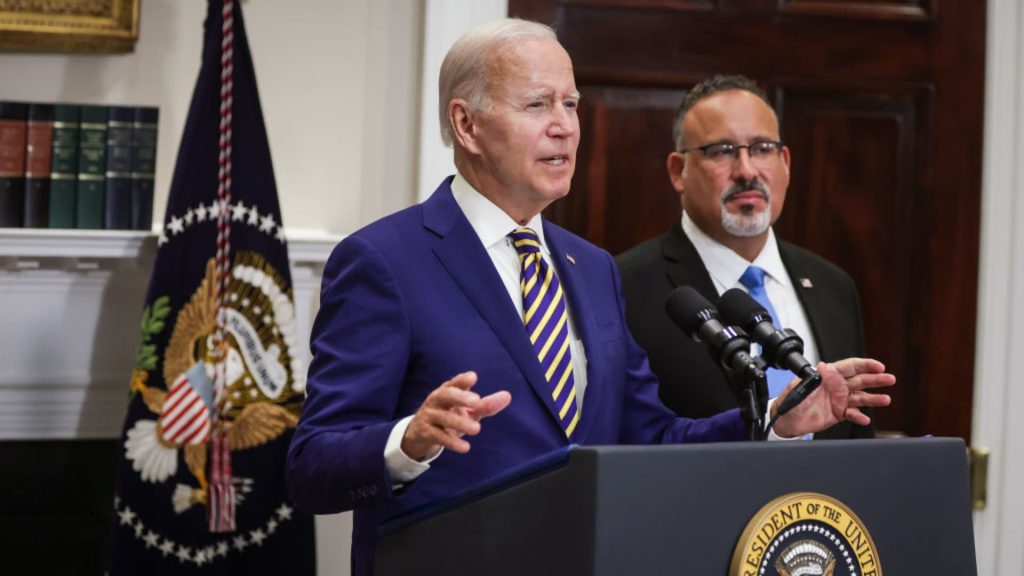

US President Joe Biden speaks about student loan debt at the White House August 24, 2022 in Washington, DC.

Alex Wang | Getty

The Biden administration on Friday asked the Supreme Court to reinstate its federal student loan program after a federal appeals court issued a nationwide injunction against the plan.

The administration’s request, which was previewed in another court filing on Thursday, lambasted the United States Court of Appeals for the 8th Circuit for blocking the debt relief package. This injunction was issued earlier in response to a lawsuit filed by a group of Republican-controlled states.

“The erroneous Eighth Circuit injunction leaves millions of economically vulnerable borrowers in limbo, uncertain about the size of their debt and unable to make financial decisions with an accurate understanding of their future repayment obligations,” wrote Solicitor General Elizabeth Prelogar in Friday’s filing with the Supreme Court. To research.

Prelogar also wrote that if the Supreme Court refuses to overturn the injunction, it may consider the filing a petition to the High Court to hear the Biden administration’s appeal of the lower court’s decision.

And if the Supreme Court accepts the administration’s appeal, it could “settle this case for expedited briefing and argument this term,” she wrote. keep the president Joe BidenThe plan’s on hold while the appeal unfolds, Prelogar said, could keep borrowers uncertain about their debts until “sometime in 2024.”

Learn more about personal finance:

Consumers are reducing their purchases of gifts

Free returns could soon be a thing of the past

Affluent Shoppers Embrace Second-Hand Shopping

Monday’s injunction by the Panel of three 8th Circuit judges in St. Louis was the latest in a series of legal challenges to Biden’s plan to forgive up to $20,000 in student debt for millions of Americans.

The Biden administration stopped accepting relief requests earlier this month after a federal district judge in Texas struck down his plan last week, calling it “unconstitutional.”

In the case at hand in the 8th Circuit, another federal judge dismissed the challenge to the debt relief program brought by the six states – Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina.

The judge ruled that if the states raise “substantial and significant challenges to the debt relief plan,” they ultimately lack the legal standing to pursue the case.

Standing refers to the idea that a person or entity will be affected by the action they seek to challenge in court.

The GOP-led states appealed after their lawsuit was dismissed.

The appeals panel ruled Monday that Missouri showed likely harm from the administration’s program, pointing out that a major in-state-headquartered loan servicer, the Missouri Higher Education Loan Authority, or MOHELA, would lose income under the plan. The Missouri State Treasury Department receives money from MOHELA.

Borrower defaults could rise amid ‘permanent confusion’

A senior U.S. Department of Education official recently warned that there could be a historic increase in defaults on student loans if its forgiveness plan is not allowed.

“These student borrowers had a reasonable expectation and belief that they would not have to make any additional payments on their federal student loans,” U.S. Department of Education Undersecretary James Kvaal wrote in a statement. criminal record. “This belief may well prevent them from making payments even if the Department is prevented from providing debt relief,” he wrote.

“Unless the Department is authorized to provide one-time student debt relief,” he continued, “we expect this group of borrowers to have higher default rates in because of the continuing confusion over what they owe”.